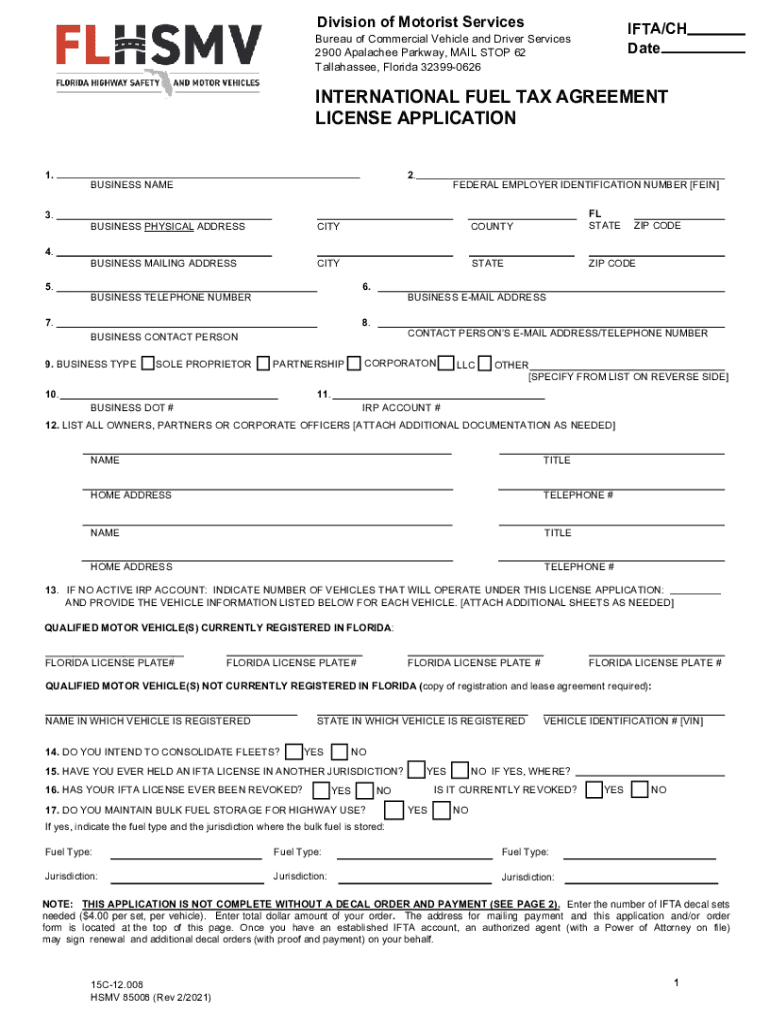

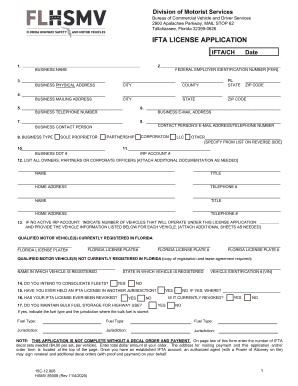

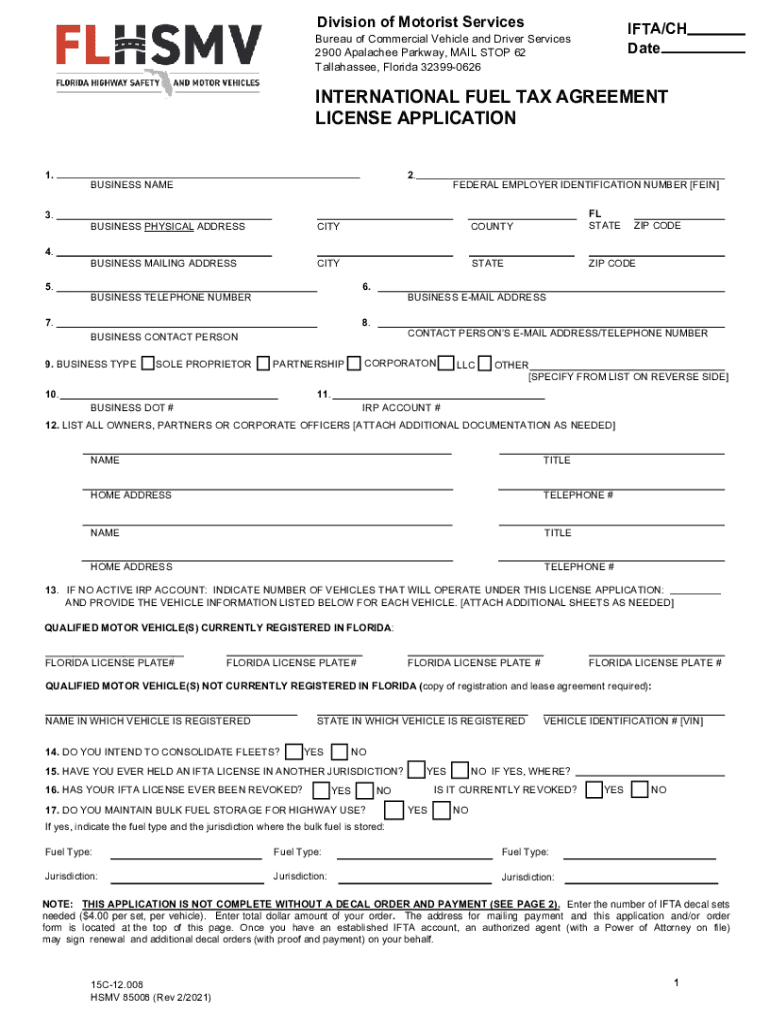

FL HSMV 85008 2021-2024 free printable template

Get, Create, Make and Sign

Editing georgia ifta application online

FL HSMV 85008 Form Versions

How to fill out georgia ifta application 2021-2024

How to fill out ifta application:

Who needs ifta application:

Video instructions and help with filling out and completing georgia ifta application

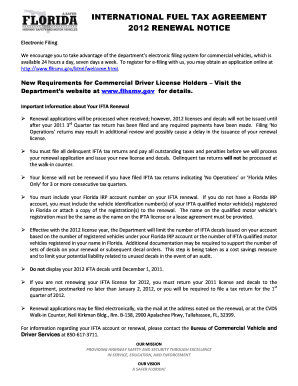

Instructions and Help about florida ifta renewal application form

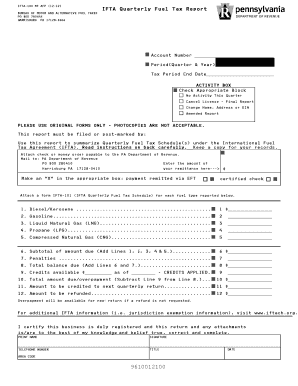

Hello and welcome to a brief overview of the money Leger program for if their returns to the USA in this video you'll see how you can easily complete your own us a fuel tax returns with this ledger let's take a brief look at the program and make a few entries the screen you're looking at now is a quarterly screen at the top you can see which quarter it is in at the bottom you can see this one tab for every quarter and every screen is the same at the very top left you can see where it says click here for current if two rates and when you click there with your mouse you'll go to a web page that has the rates posted and below that you can see you have all the states plus below that we have all the Canadian provinces listed along with their abbreviations and to the right is where you would put your if their rates and exempt we enter them all or enter the ones where you're traveling only once you've got them entered you just click Save, and you're good to go in the middle area in the yellow section is where you make your entries, and you log your miles and fuel purchases and to the right automatically being populated is a quarterly fuel tax summary report, and it'll show up here and at the top you can see where the dates are you can change the dates from one year to the next and use this year after year and when you're done you just use the handy print button and your reports are done okay let's do a few entries third of January let's say you were in a near old listed here South Dakota and going into South Dakota your doctor reading was 7800 miles and when you left South Dakota you were at 80 300 miles and here it shows distance traveled, and you can simply click that button, and it shows you the calculated amount of 500 miles traveled in South Dakota now if you're not wanting to record odometer readings, and you simply want to enter the amount of miles traveled you simply can do that here, and it'll work in this case we're going to use our doctor readings, so we're going to use the calculated value if you have a non-taxable mile you can enter it there and if you purchase fuel you just put in the number of gallons, and you're done the entry nothing will show up here yet on the first entry it'll take a second entry until you see some refunds and so on okay can you're carrying on 4th of January you're now in North Dakota you can simply type in or pick the abbreviation off the list and here in North Dakota you can enter in your manually, or you're entering odometer reading, or you can simply choose the last Adam reading we're a doctor reading where you left in this case South Dakota have eighty-three hundred miles which was here right and then to the right of that we choose when we left North Dakota we're at eighty-eight hundred miles and our distance travel is five hundred again, and we didn't purchase any feel, and we're all set now to the right you can see everything is being calculated for you taxes due and refunds and the net totals at the bottom...

Fill ifta florida application : Try Risk Free

People Also Ask about georgia ifta application

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your georgia ifta application 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.